Barcelona's Champions League analysis: Tactics of Porto, Shakhtar & Antwerp

Barcelona have struggled in the Champions League. Despite talent and high hopes, they've repeatedly fallen short. So how can they set up to qualify from the group stage?

For years now, Barcelona have struggled to be a relevant force in the Champions League. Ever since Luis Enrique's title-clinching campaign with MSN in tow, the Catalans have been failing - and often failing miserably - on the grandest club football stage of them all. And sometimes, it was a question of ability, sometimes of luck, but either way, even Xavi's arrival did little to change their European fortune.

This season, however, fate has been most kind to the Blaugrana. Group H saw them draw Porto, Shakhtar Donetsk and Antwerp. All three teams will have their say but all three are significantly weaker than Barcelona -- on paper.

So, what can we expect from them and Xavi's squad in the Champions League?

Porto

Porto will arguably embody Barcelona's toughest challenge in the group stages of the Champions League. Among the three opponents the Catalans will face, they are the most formidable and the team that could pose the most threat to Xavi's perfect start to a brand new European journey. Sérgio Conceição's troops finished 2022/23 second, just two points behind Benfica who were crowned Portuguese champions in the end.

But their campaign was still quite impressive: 27 wins, four draws and only three defeats, scoring 73 and conceding only 22 in the process. By all standards, Porto are a domestic juggernaut and should be treated as such. And while they may not be European royalty right now, they can still certainly hold their own. In 2022/23, they even topped their group ahead of Club Brugge, Bayer Leverkusen and Atletico Madrid, only to be eliminated by Inter Milan, the eventual finalists, in the Round of 16 by a solitary goal on aggregate; undoubtedly a formidable achievement.

But what do we know about Porto's style of play? Domestically, they are a dominant force; they control the possession, score the goals, press high and outplay the opposition. But the Champions League is not Primeira Liga. So what changes can we expect from them in Europe?

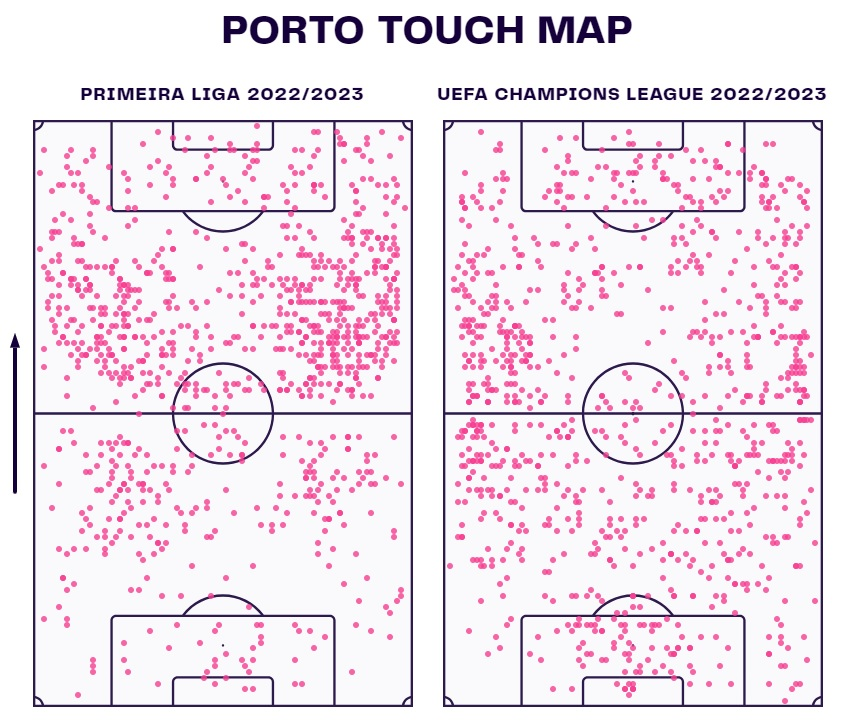

One thing to note here is that the sample difference is huge; the domestic league is far longer than any European campaign, especially when you exit as early as the Round of 16. However, there is enough there to give us an idea of how Porto changed their approach. Despite topping their group by winning 4/5 games and keeping their final match against Inter Milan a tight affair, Porto were not the dominant force we knew in Primeira Liga.

Looking at the graph above, we can see how their in-possession tendencies changed for Europe. Domestically, dominating the ball was far easier and as a result, Porto would often pin the opposition down more easily and access the half-spaces on either side, recycling and combining inside the final third. In the Champions League, however, they had issues accessing the central areas and were often pushed far deeper and far wider as a result.

Even in a largely successful group stage, their underlying metrics were all far from their domestic highs; they were still scoring more goals than the opposition but their possession had decreased, their positional attacks were less regular and their reliance on transitions increased.

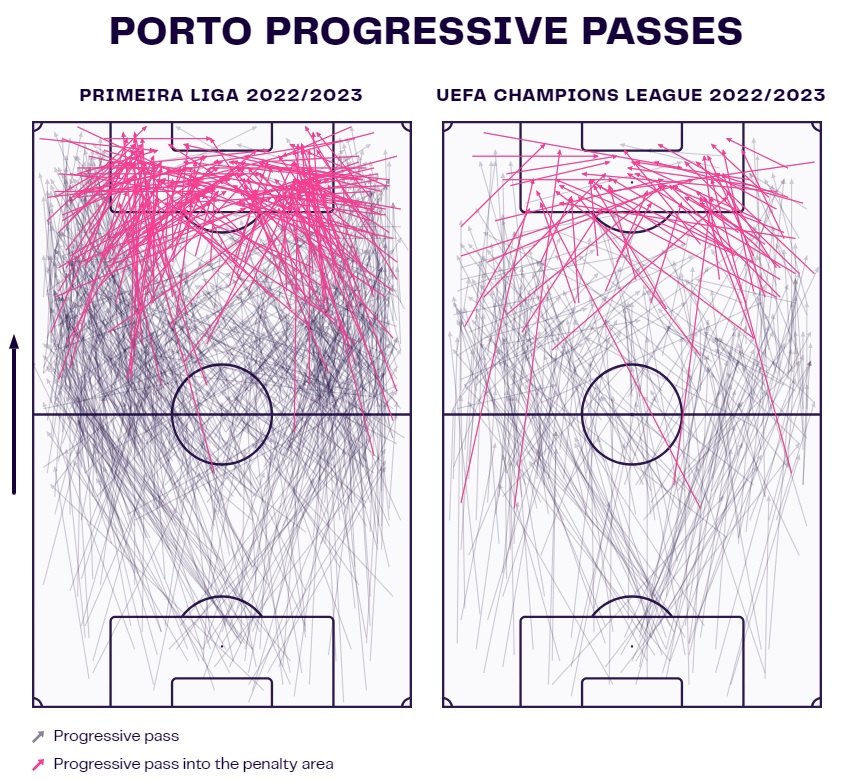

The progression graphs tell us quite the story; domestically, Porto still like to access their wide areas early and will do so from deep. However, their middle third of the pitch is quite busy too, meaning they enjoy stable phases of possession often. In Europe, however, that's rarely the case; Porto will go long into the wide areas and then from there, they try to flood the box with crosses from the deep.

Often, this means using any kind of time and space on the ball to go long. But again, the half-spaces seem to be key for their distribution; we can see that from the passes into the penalty area and by how the maps get busier in those sections of the pitch. Statistically, their pass length and long pass ratio increase while the average number of passes per possession decreases compared to their domestic league numbers. But even in Primeira Liga, they are among the teams who use the most long balls as well as through passes that penetrate lines from a deeper position. They also like to carry the ball quite often.

But even when winning, Porto are far more often subdued in Europe. So much so that they will be comfortable skipping the second phase entirely and hit the space as quickly as possible.

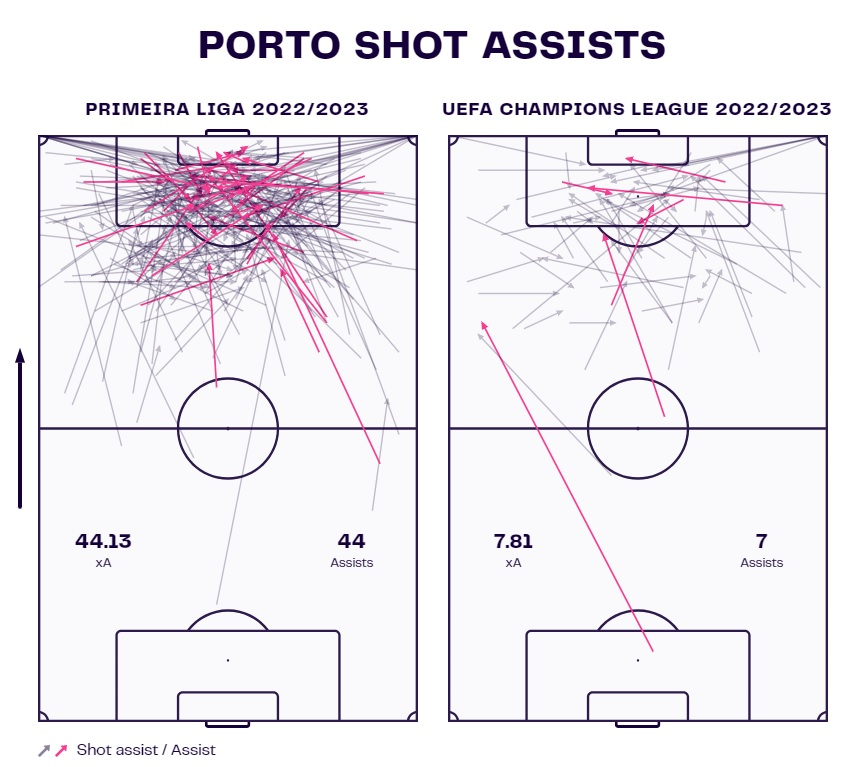

When we look at their shot assists and pure assists, the situation follows a similar pattern: Port try to create from wide areas but it's done with a lot less sustained pressure. Passes will be followed up with shots from a distance and their creators will often sit outside of attacking blocks, meaning the final pass may - more often than not - come from deeper areas of the pitch. It's interesting to note that in both instances, they have underperformed their expected assists ever so slightly.

While the difference is not statistically that relevant, it could still pose a question in Europe where every little misplay or wasted opportunity matters a lot. But the shot distance isn't that different compared to their domestic figures. In fact, domestically they averaged a shot from 16.6 metres while in Europe, that only rose to 16.81. This means these kinds of attempts are more or less the norm for the Portuguese team.

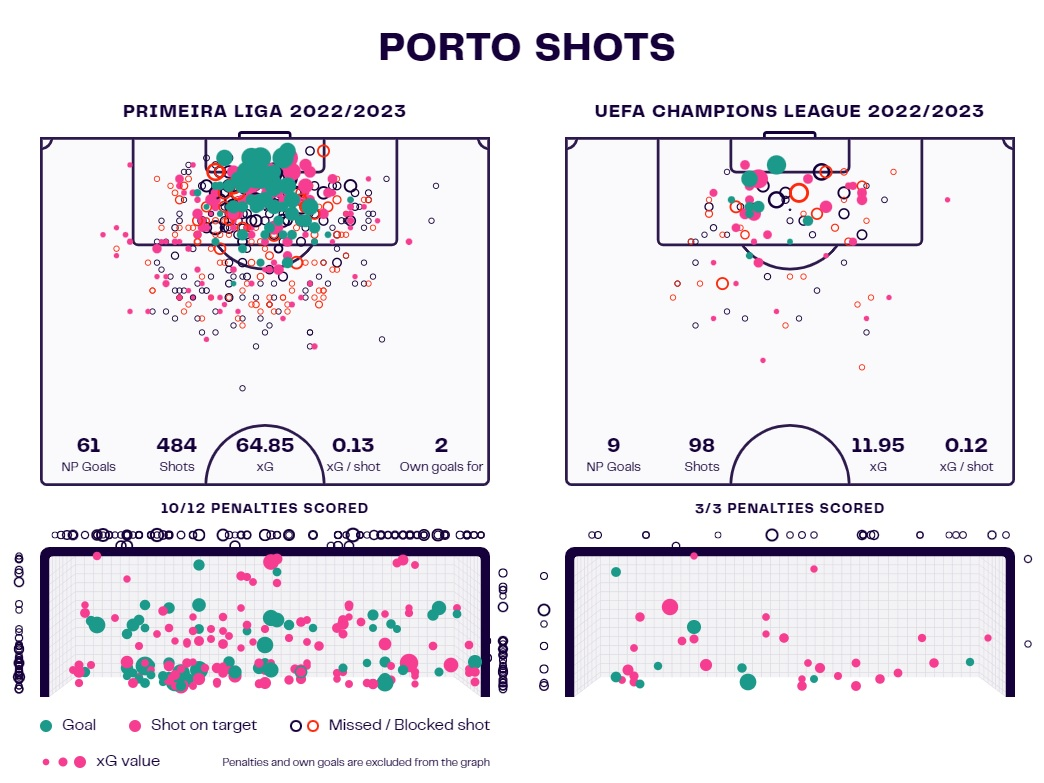

You can see it here too; they love their attempts from a distance and around the edge of the box. Even when it comes to domestic performance, Porto get a lot of touches in the box. However, they have underperformed their expected goals values in both campaigns, in a statistically significant manner too. The reason behind it is that Porto tend to miss their high xG chances, as can be seen more clearly from the shot map on the right. Again, this indicates a dose of unreliability in putting the finishing touches, which could be costly in Europe.

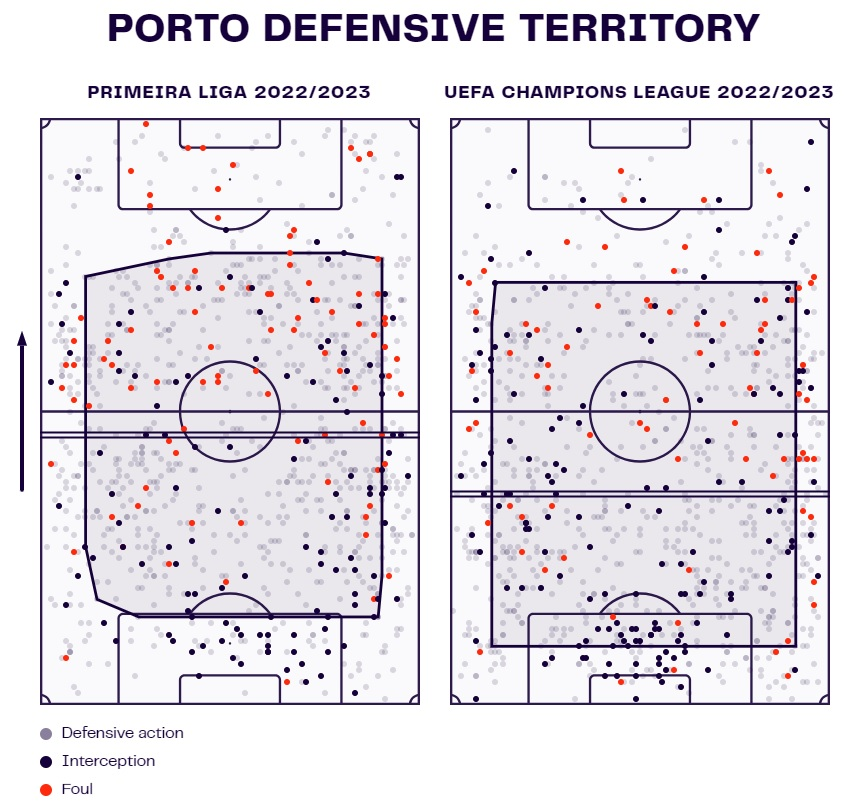

Finally, however, we have to discuss their defensive approach. Even though they are quite an aggressive team in general, Porto are more than likely to succumb to Barcelona's possession dominance. In 2022/23, that shift from an aggressive high line to a more conservative low-to-mid line was clearly visible.

In Europe, Porto defended deeper into their half and lower into the opposition's while the height of their defensive line is significantly deeper on the graph to the right side as well. All of this, combined with the attacking data, indicates we're likely to see a more subdued version of this team. Domestically, they are among the highest-pressing teams with the highest challenge intensity in the league, but that will likely not be replicated in Europe.

Shakhtar Donetsk

The next team on the list is Shakhtar Donetsk, the champions of the Ukrainian VBET League. Again, on paper, this is a squad Xavi's Barcelona should still beat comfortably but not one that should be taken overly lightly either. 2022/23 was a success for them but Patrick van Leeuwen is still fresh at the helm and having only been the official coach since July, there's not exactly a big sample to work with. However, we do know what Shakhtar looked like under Igor Jovićević last season.

They finished first, five points ahead of Dnipro, tallying 22 wins, six draws and only two losses, enough for a fairly comfortable campaign. The situation across the board in other metrics is quite similar too: they top the charts in goals scored, expected goals, possession, total passes, and shots and are among the top in numerous other categories as well.

Domestically, Shakhtar are a dominant force and have started 2023/24 in much the same manner under their new coach. But how does that dominant style usually translate to European football?

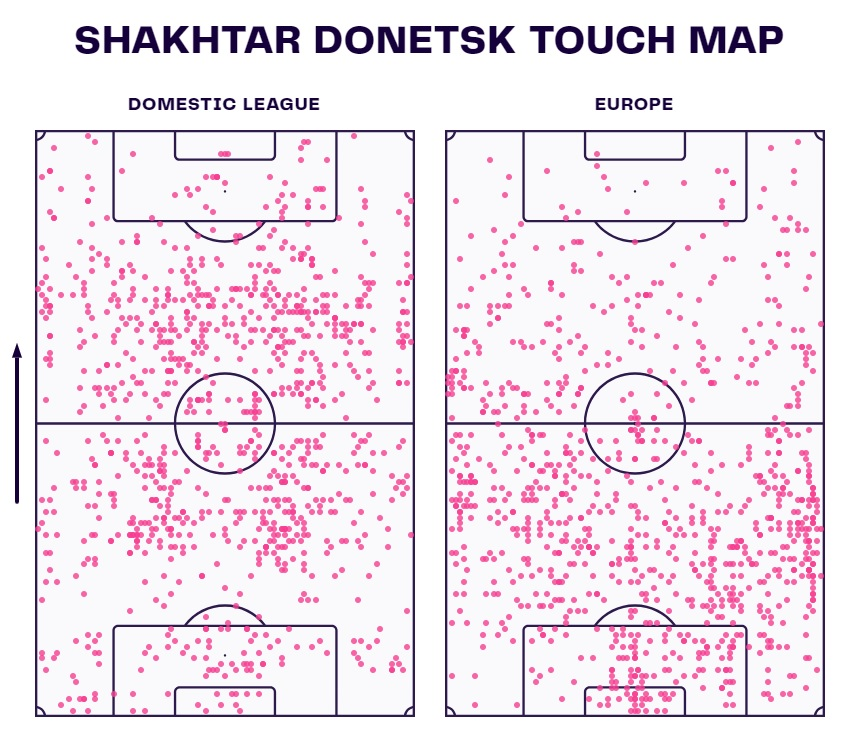

Last season, the difference was palpable, to say the least. On the left, we see a team that can build up from the back, hold onto the possession and then camp in the opposition's half once they've been successfully pinned down. On the right, however, we see a team that's largely been pinned down themselves and struggles to play out. This is the reality of this Shakhtar team, especially considering they've since lost some of their great outlets and key players like Mykhaylo Mudryk and David Neres, who went to Chelsea and Benfica respectively.

Of course, a big reason for their misfortunes in Europe was the difficult group that saw them finish third behind Real Madrid, RB Leipzig and just ahead of Celtic who only managed to salvage two points. We shouldn't forget it was also this Shakhtar team that succeeded in somewhat rattling Real Madrid but other than that draw which 'felt like a win', they've not managed to tally a single victory throughout the group stage.

And now, with a coach who's still very fresh, and with a team that's arguably individually weaker, they might be there for the taking. Looking at their passing networks next, the difference is once again visible.

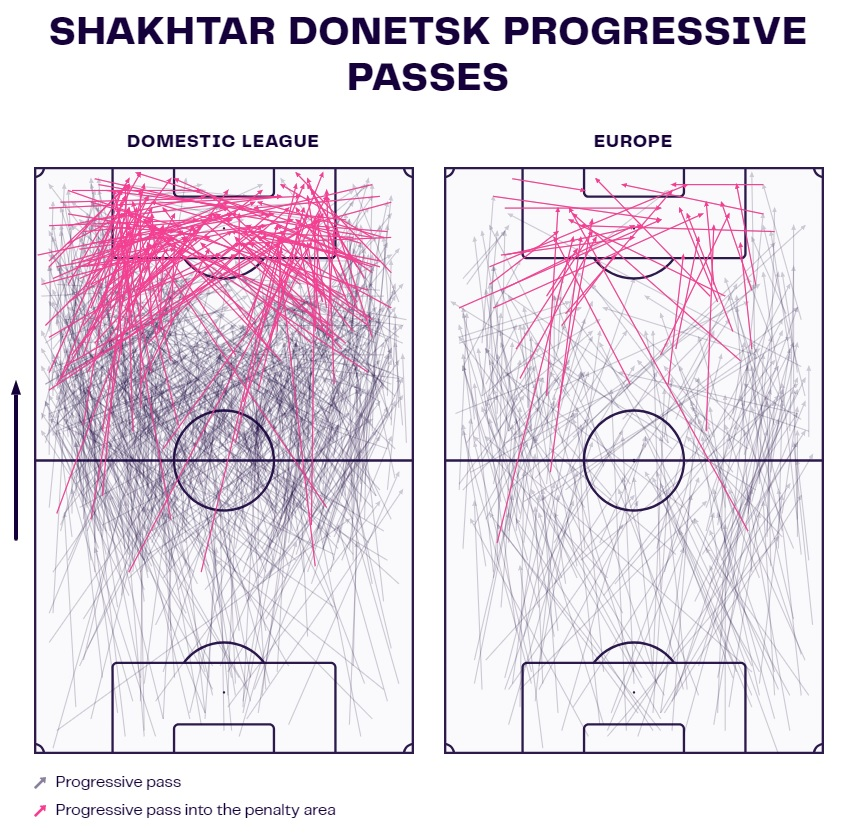

The data is quite clear on their European campaign too; Shakhtar tallied fewer passes per 90 and per possession, played more long passes with the average pass being longer than domestically and relied on such passes more than usual. This is quite the contrast to their domestic style, which is far more possession-dominant and overall more controlled. Their games in the VBET League are usually played at a lower match tempo too, confirming the higher dose of control they generally have in the Ukrainian first division.

All of that leaves little doubt as to what to expect from Shakhtar Donetsk once the Champions League kicks off; they are more likely to relinquish that same control they usually exert domestically and aim to skip entire phases of play, as we can also see above in the picture on the right. But their tools to create and the areas they most create from interestingly remain the same.

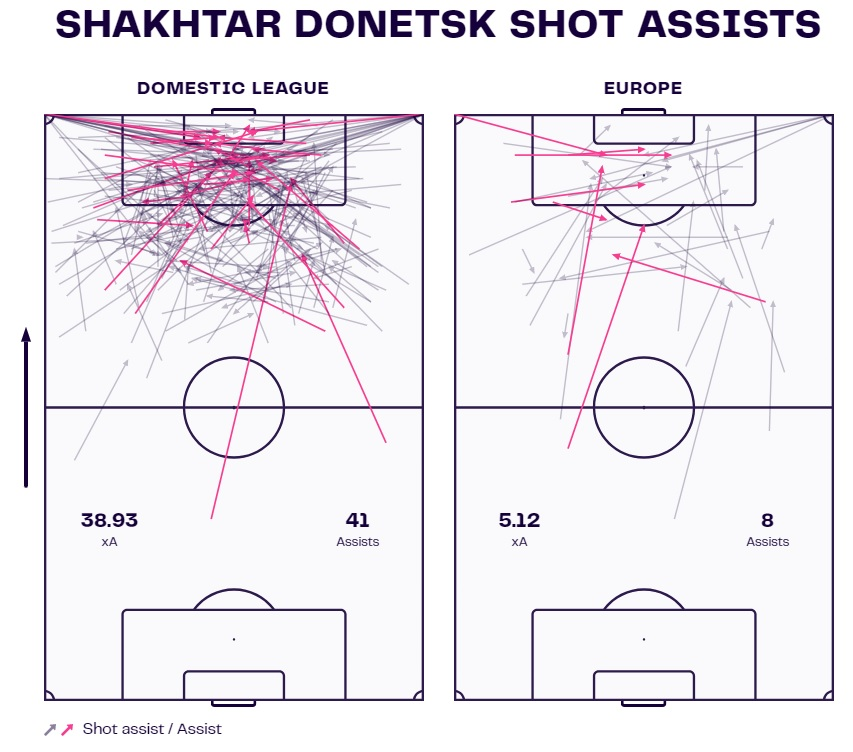

There is a big emphasis on distributing the ball into the box from either half-space and it's reasonable to assume this won't change despite the change in scenery from domestic to European. We can see more in the graphs below which will show us their shot assists and pure assists.

It's quite interesting to note how as opposed to Porto who generally underperform these underlying metrics, Shakhtar Donetsk are the exact opposite. Looking at their 41 assists in the domestic season and eight in the European campaign, we see that in both cases the data claims they were indeed overperforming those expected values. And surely enough, the crosses and long ball distributions are once again quite important here as we see a good number of them were turned into assists or shot assists.

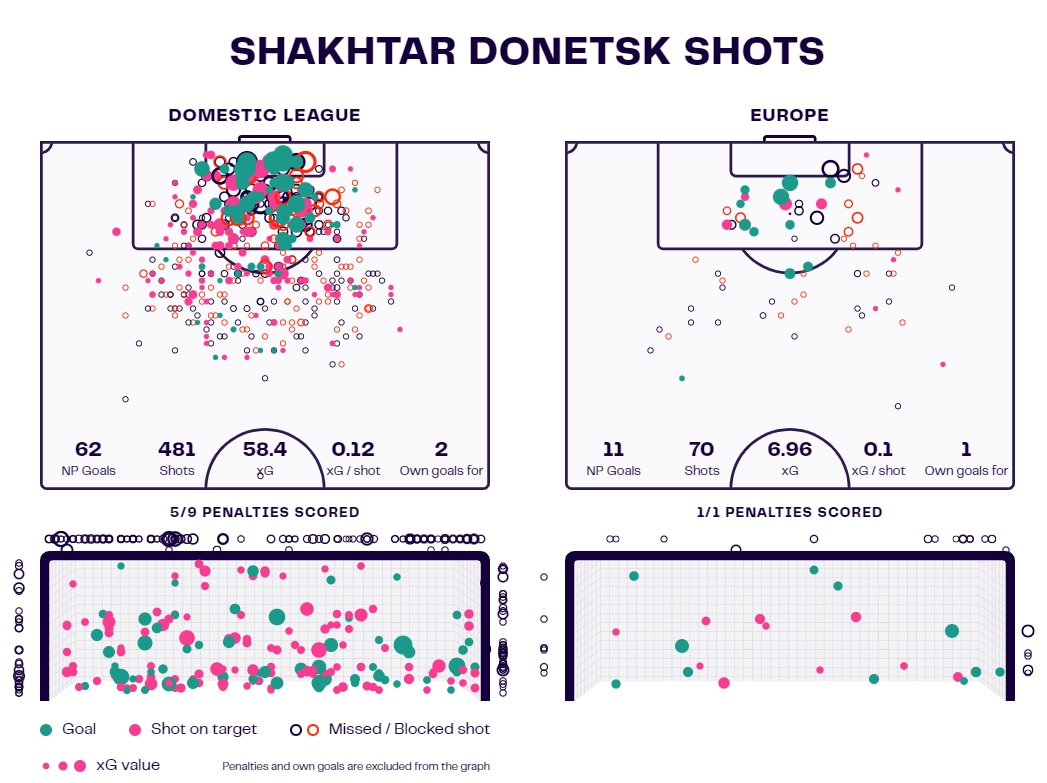

But these graphs also show us the importance of Shakhtar's set-piece plays. Both domestically and in Europe, they were a force to be reckoned with during corner kicks and breaks in play. This, combined with the regular overperformance of their expected assists values, is a great tool to have, especially in European football. All of this is further reinforced when we take a look at the shots taken below.

The expected goals and actual goals comparison confirm the theory of Shakhtar converting chances they shouldn't necessarily convert. Looking at their shots, especially in Europe, most of the goals and even attempts on target in the area had low xG values. And yet, Shakhtar comfortably put away 11 non-penalty goals when they should've had seven at most.

Domestically, it was a similar story, albeit a more dominant one overall for the Ukrainian champions. They scored 62 non-penalty goals while according to the xG they should've had around 58. An overperformance of ~4 is not such a big deal in a 30-game season but a ~4-goal overperformance across six Champions League games is quite something.

Shakhtar may not be a juggernaut team in Europe but they will take every chance you give them and capitalise on it. Finally, however, we have to analyse their defensive setups.

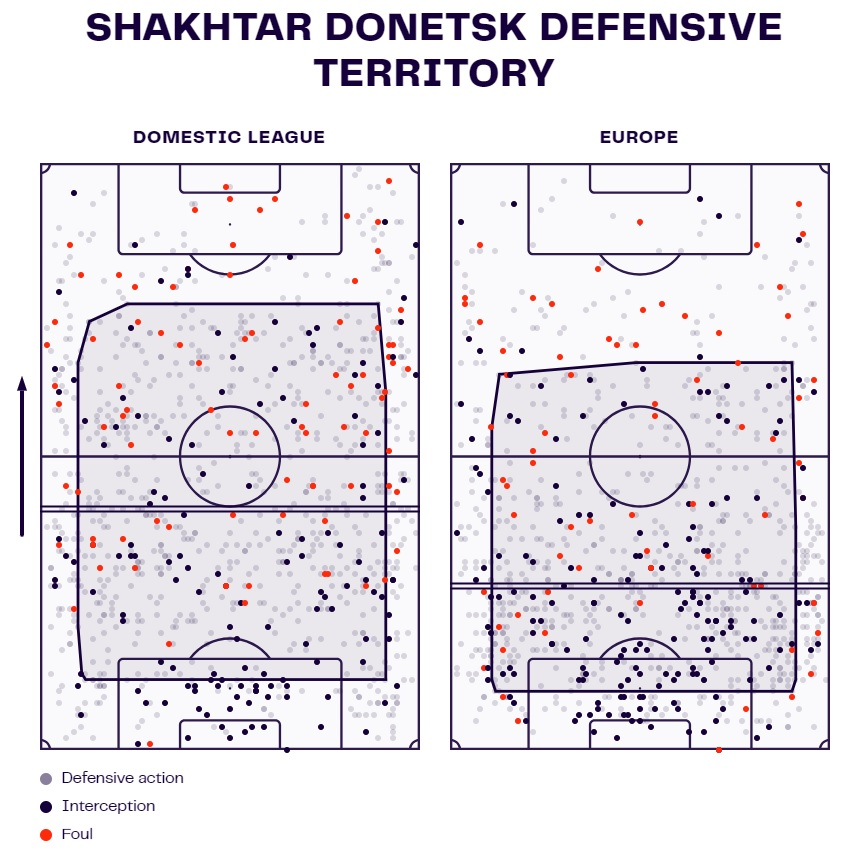

The difference between Shakhtar domestically and Shakhtar in Europe is quite astonishing. We're talking about a team that went from 8.64 PPDA and being among the most aggressive teams in VBET League to 18.75 PPDA in Europe, defending in deep blocks and holding an incredibly low defensive line. This, however, is their reality, especially given the circumstances surrounding the new team with a new coach.

They don't have much going for them, at least not on paper, but they are still a team that will take your whole hand even if you only give them a finger.

Antwerp

The final contestant and perhaps the biggest unknown in Barcelona's group stage are Antwerp. The Belgians finished third in their regular season, recording 22 wins, six draws and six defeats in 34 games but then achieved a glorious run in the Championship Round, topping the group ahead of the other contestants and thus securing Champions League football.

Antwerp are, of course, the rookies of the grandest club football stage on the planet and to be drawn in the same group as Barcelona may be harsh. Nonetheless, they do have the potential to surprise and will be an enigma to most teams in Europe. When analysing their games, however, we had to use their 2022/23 UEFA Conference League campaign and compare it to the First Division A as those were our only samples.

Still, playing in the Conference League one season and then stepping up into the Champions League the next might be too big of a leap for them. The difference in quality is simply staggering. That said, however, it's interesting to see how they adapted to European football in 2022/23.

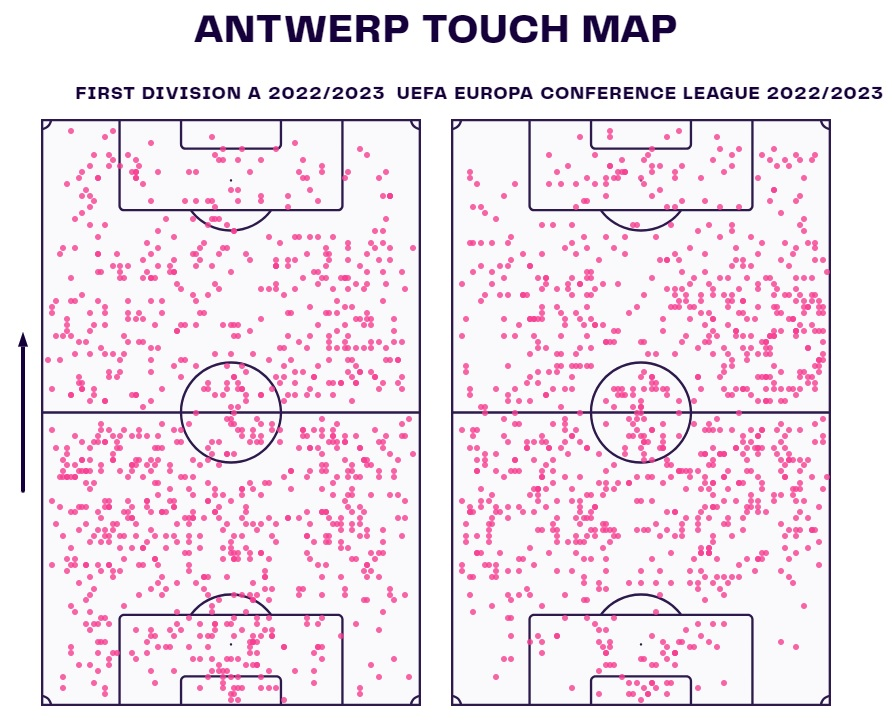

Looking at the touch maps above, it does seem Antwerp didn't change much going from Belgium's first division to Europe. In 2022/23's domestic campaign, they were among the most dominant teams in possession of the ball; they liked to play a lot of passes, control the game and playmake. In fact, they ended the season with the third-most passes, fifth-highest passing rate and second-best possession percentage at 55.7 on average. All in all, quite impressive.

But what's even more impressive is that they tried to maintain that style of play heading into the European waters too. The graphs above show us exactly that. Their UEFA Conference League campaign was still decent, tallying three wins, two draws and one defeat across six games. Sadly for them, a 4-2 defeat against İstanbul Başakşehir on aggregate sealed their run. But Antwerp still largely played to their strengths.

They maintained 57.7% possession, recorded way above average number of passes per game and were even in the top 10 teams with the highest passing rate in the competition. In essence, Antwerp stayed true to their principles as much as they possibly could. For better or worse.

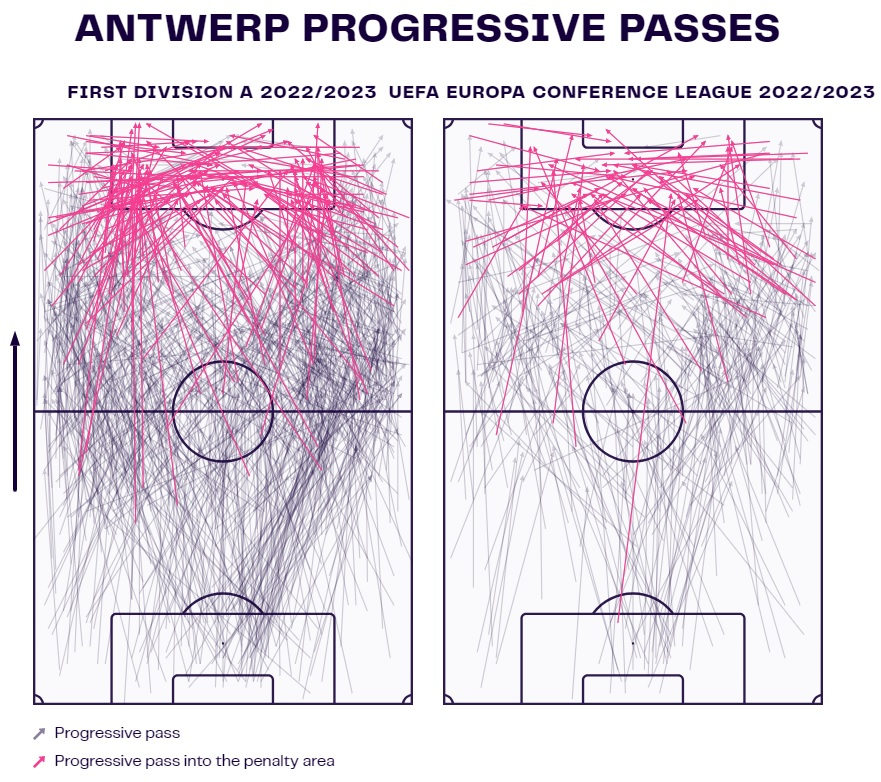

This is somewhat visible in their progression charts as well. The two graphs look similar but obviously, it was far easier for Antwerp to do what they like to do domestically than it was in Europe; they are a team that likes to have the ball but also a team that isn't afraid to go long when and if needed. Even in the First Division A last season, they were the team with the second-most long balls in total and fifth per 90. So long distribution is part of their style too.

Interestingly, in Europe, they played at a higher match tempo but relied on those long balls somewhat less often than usual. In fact, they even managed to record more passes per 90 than they had domestically before that. By all means, Antwerp are a courageous team who stick to their guns. Their main tools of creation stem from those long distributions but they also like to play through balls and execute deep completions, i.e. non-cross passes that are targeted to the zone within 20 metres of the opponent's goal. These are often cutbacks from the wide areas or the half-spaces, as you can see in both graphs above as well.

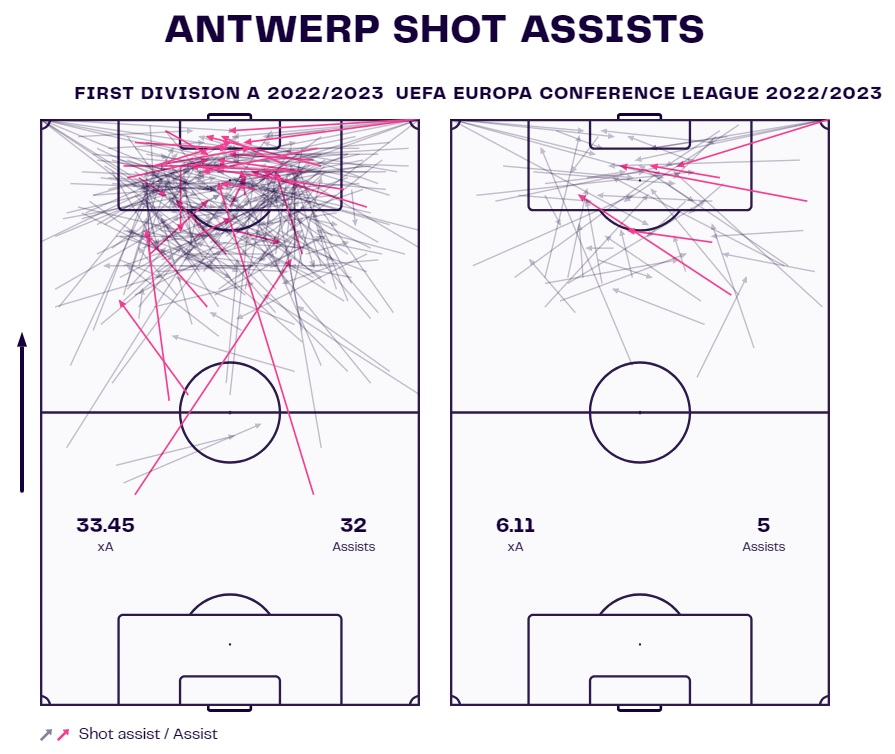

The long balls from very deep are also a staple and it wouldn't be outrageous to assume they will get even more prominence once the Champions League kicks off. But it's quite interesting to compare their domestic shot assists and assists to the European ones.

The numbers also tell us Antwerp underperformed their expected assists, albeit not by much. There is about a goal difference in both of those scenarios and while a goal can often make or break your European campaign, at this stage, we wouldn't call this an alarming revelation just yet. But these graphs also demonstrate Antwerp's deliveries are excellent. Both their domestic and Conference League campaigns included set-piece assists and shot assists, which may prove useful against much tougher European competition.

However, despite that long-ball approach we mentioned earlier, we can see from the domestic pass map that many of those assists originated inside the box. That reinforces the notion of Antwerp as the ball-dominant and positional team but since the European map is much more long-delivery-focused, it does pose a question as to how effective they will be at breaking down defensive structures with intricate passing. They may try to stay true to their ideals but it could cost them in a competition that's as ruthless as they come.

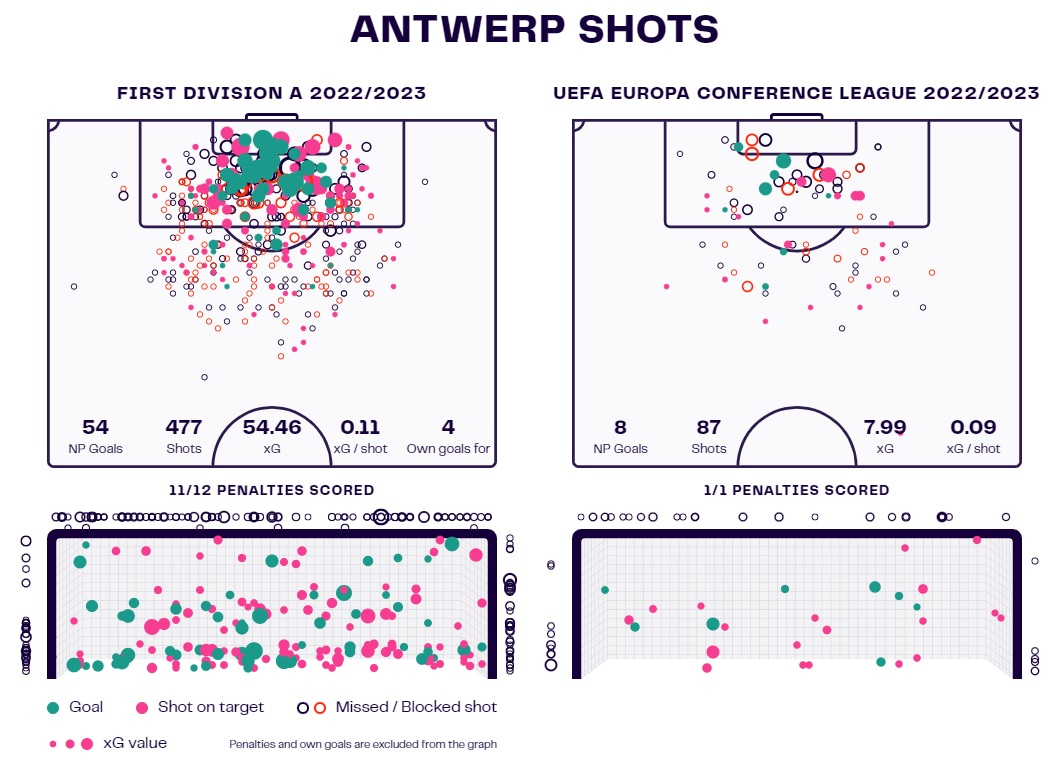

Looking at their shooting tendencies, the numbers and the actual goals add up; Antwerp are generally quite good at converting their chances and scored in line with their expected goals across 2022/23. It is worth noting, however, that the quality of their shots decreased, albeit not drastically, going from domestic competitions to European ones. But even so, that did not reflect in their final goal-scoring record.

Interestingly, they were also among the teams with the second-most penalties given in the Belgian First Division A and also the team with the second-most touches in the penalty area. These two stats go hand-in-hand, signalling Antwerp are very good at occupying key areas in the box and are often rewarded for it. Whether this continues to be true in the Champions League, however, remains to be seen.

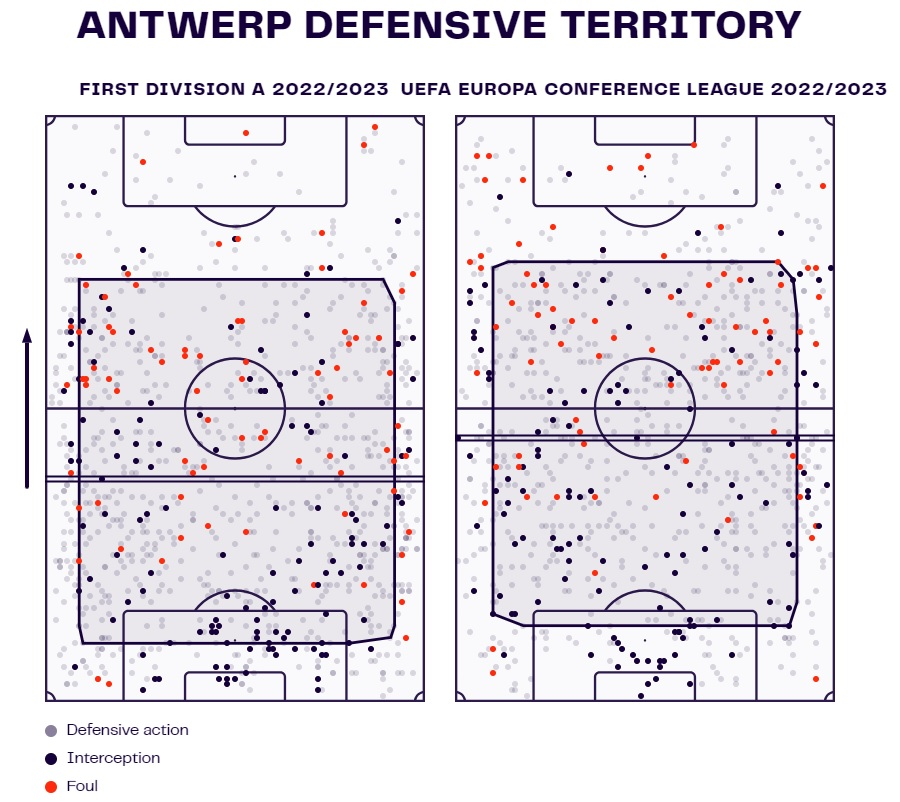

Finally, we have to address their defensive shapes because Antwerp's successful 2022/23 is largely down to their ability to defend well. Domestically, they only conceded 34 goals, the least of all teams in the league. It has to be noted, however, that the expected goals against predictor stated they should've conceded 40 instead. It's quite a big contrast and could pose a question about their defensive solidity once they're inevitably faced with much higher-quality opposition.

In terms of defensive style of play, Antwerp are the only team on this list who defended more aggressively and with a higher defensive line in Europe than domestically. The data confirms this too; they tallied lower PPDA numbers in the UEFA Conference League, albeit not significantly so, and managed to maintain an average challenge intensity as well. That number, however, was somewhat lower in Europe.

All in all, Antwerp seem like a team that will try to stay true to their ideals regardless of the opposition. But once that opposition's level inevitably skyrockets in the Champions League, will they be able to keep up?

Only time will tell.